Irs Payment Calendar 2025 Pdf. The extended due date for 2025 domestic trust, estate, and partnership tax returns is 17 july 2025. A brief description of the due dates for the irs quarterly payment is as follows:

The irs ctc offers monthly payments to the eligible recipient, and all those payments are scheduled for the 15th of each month.

Irs Payment Schedule 2025 Calendar, This revenue procedure modifies rev. A brief description of the due dates for the irs quarterly payment is as follows:

Federal Pay Period Calendar 2025 2025 Calendar Printable, Here, certain important tax credit dates are mentioned: Since the program hasn’t officially.

2025 Irs Quarterly Payment Dates Aurore Constantine, Since the program hasn’t officially. The extended due date for 2025 domestic trust, estate, and partnership tax returns is 17 july 2025.

Irs Payment Dates 2025 Calendar Berry Natassia, The deadline for tax payment. The second estimated due tax payment for 2025 was made on 17 july 2025.

Irs 2025 Quarterly Tax Payment Schedule Tine Adriana, The second form 941 for 2025 and the accompanying payroll tax payment were due on july 31. The irs ctc offers monthly payments to the eligible recipient, and all those payments are scheduled for the 15th of each month.

Irs Tax Calendar 2025 Lila Shelba, The third estimated due tax payment, 2025, will be done on 16 september 2025. Since the program hasn’t officially.

Irs Quarterly Tax Payment Dates 2025 Elvera Grethel, Since the program hasn’t officially. The second form 941 for 2025 and the accompanying payroll tax payment were due on july 31.

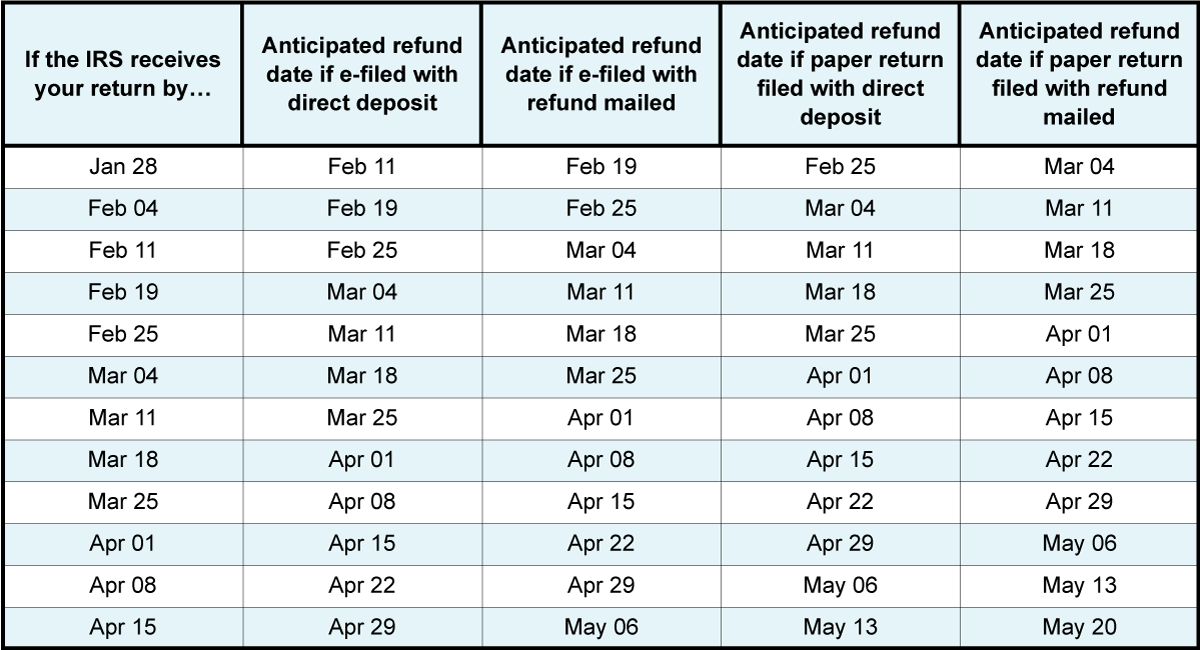

What Is The Irs Tax Refund Calendar For 2025 Dareen Maddalena, The second estimated due tax payment for 2025 was made on 17 july 2025. However, if you made the full deposit for the quarter on time, you.

Irs 2025 Tax Schedule Linnell, The second estimated due tax payment for 2025 was made on 17 july 2025. This revenue procedure modifies rev.

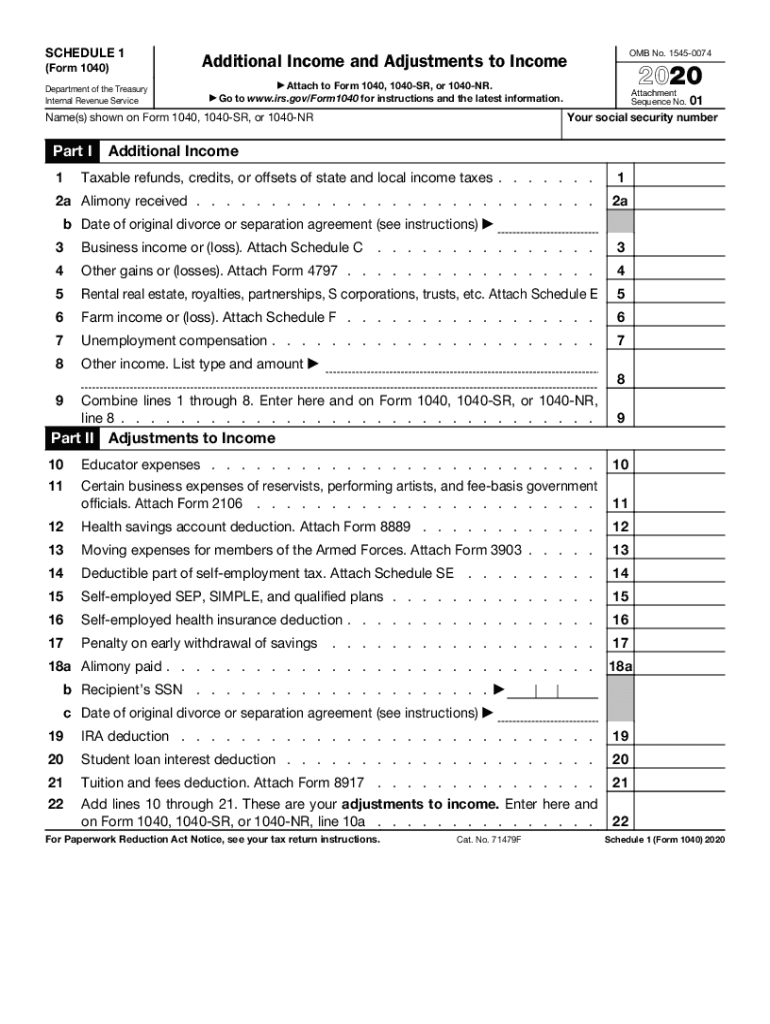

Irs Form 1040 Instructions 2025 Cybil Dorelia, The irs ctc offers monthly payments to the eligible recipient, and all those payments are scheduled for the 15th of each month. Since the program hasn’t officially.

The irs ctc offers monthly payments to the eligible recipient, and all those payments are scheduled for the 15th of each month.